- February 20, 2024

- Posted by: simba001

- Category: Business Insights

In today’s fast-changing digital world, how we pay for things is constantly evolving. For Kenyan retailers and restaurant owners, it’s important to keep up with these changes to stay competitive and keep customers happy. In this blog post, we’ll talk about what the future holds for credit card payments and M-PESA, and how businesses can prepare.

The Rise of Digital Payments

Digital payments are becoming more and more popular worldwide, and Kenya is no exception. People are using their phones and cards to pay for everything from groceries to meals at restaurants. This trend is only expected to grow in the coming years as technology continues to advance.

Contactless Payments

One of the biggest trends in payment technology is contactless payments. This means you can pay for things without having to swipe or insert your card. Instead, you just hold it near a card reader, and the payment goes through. Contactless payments are not only faster and more convenient for customers, but they’re also more secure because they don’t require physical contact with the card reader.

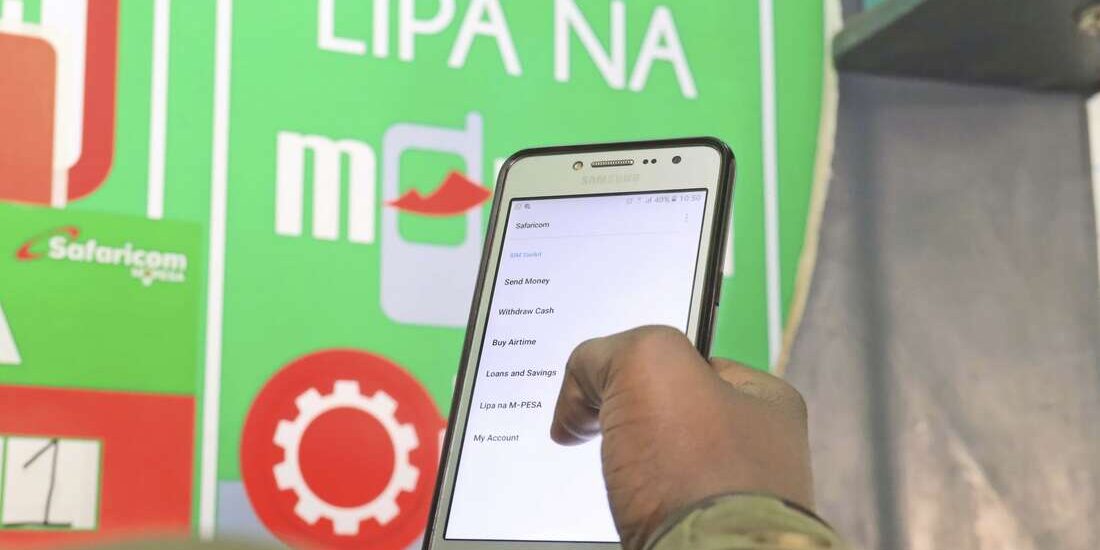

Mobile Wallets like M-PESA

In Kenya, M-PESA has revolutionized the way people send and receive money. But it’s not just for person-to-person transactions anymore. Businesses are starting to accept M-PESA payments too, and this trend is likely to continue. M-PESA offers a convenient and secure way for customers to pay for goods and services, and it’s especially popular in areas where people might not have access to traditional banking services.

What This Means for Kenyan Businesses

For retailers and restaurant owners in Kenya, staying ahead of the curve when it comes to payment technology is crucial. Customers expect fast, convenient, and secure payment options, and businesses that can’t meet these expectations risk losing out to competitors.

How to Prepare for the Future

So, what can Kenyan businesses do to prepare for the future of payments? Here are a few tips:

1. Invest in the Right Technology:

Make sure your business has the right equipment to accept digital payments, including contactless cards and mobile wallets like M-PESA.

2. Train Your Staff:

Make sure your staff are trained on how to use the new payment technology so they can assist customers effectively.

3. Promote Digital Payments:

Encourage your customers to use digital payment methods by offering incentives or discounts for using them.

4. Stay Informed:

Keep up with the latest trends and developments in payment technology so you can continue to adapt and evolve your business.

In conclusion, the future of payment solutions in Kenya is bright, with digital payments set to play a key role. By embracing new technologies like contactless payments and mobile wallets, Kenyan retailers and restaurant owners can stay competitive and meet the changing needs of their customers.